As the summer heat rises, the economic news slows down. This week’s Inside the Economy with SH&J focuses on Thursday’s Brexit vote as well as newly released U.S. consumer debt figures. Listen in to find out which U.S. state has risen to the #6 seat in the world’s largest economies and why we likely won’t be seeing interest rate increases this summer.

Year: 2016

8 Important Times in Life to Talk with Your Financial Planner

Life moves quickly and big changes often happen in the blink of an eye. As your life circumstances change, it’s important to meet with your financial planner to discuss the potential impact to your financial plan and goals.

Life moves quickly and big changes often happen in the blink of an eye. As your life circumstances change, it’s important to meet with your financial planner to discuss the potential impact to your financial plan and goals.

Getting Married

Merging two sets of finances together can be difficult. Shortly after you get married, or even before the big day, meet with your financial planner together. They will help you discuss goals, direction for investments and can create a joint financial plan. Combining assets can be much less stressful when you include your financial planner in the process.

Buying or Selling a Home

Your home is likely the largest purchase you will make in your lifetime. When buying, most real estate agents will recommend you talk with your lender to find out what you qualify for, yet the agent and lender rarely consider any of your other financial goals in the equation. On the selling side, the impact of the sale on your overall financial plan is rarely taken into consideration. Since your financial planner understands and is trying to help you achieve all of your long term goals, talking with him/her before buying or selling a home can help you stay on track and avoid mistakes. Continue reading

Boosting your Social Security Beyond Age 70

Did you know that you can increase your Social Security benefits beyond age 70? Many are now familiar with the delayed retirement credits that individuals earn by delaying collecting their Social Security benefit until age 70. A delayed retirement credit is an 8% increase in your monthly benefit for each year you delay collecting benefits after your “normal retirement age”. Although delayed retirement credits do not continue to accrue beyond age 70, there actually is a way that you can continue to increase your benefits. While many people may not find it feasible to work beyond age 70, those who enjoy their job and continue to work could see an increase to their monthly benefits. Continue reading

Did you know that you can increase your Social Security benefits beyond age 70? Many are now familiar with the delayed retirement credits that individuals earn by delaying collecting their Social Security benefit until age 70. A delayed retirement credit is an 8% increase in your monthly benefit for each year you delay collecting benefits after your “normal retirement age”. Although delayed retirement credits do not continue to accrue beyond age 70, there actually is a way that you can continue to increase your benefits. While many people may not find it feasible to work beyond age 70, those who enjoy their job and continue to work could see an increase to their monthly benefits. Continue reading

Inside the Economy with SH&J: June 6, 2016

This week’s Inside the Economy with SH&J provides updates on the jobs report released last week and the effect it had on the bond market as well as the likelihood for the Federal Reserve to raise rates in June. An increase in average hourly earnings has created a concern about increased automation leading to elimination of some minimum wage jobs or jobs going to more highly educated individuals. Listen in to hear more on the continued inflow of new money into the U.S. from overseas in search of safety and liquidity.

Getting the Most Bang for Your Remodeling Buck

Sometimes, your home is one of the largest investments in your ‘portfolio’. Whether you are looking to stay in your home for a while or are considering selling soon, it’s important to pay attention to which remodeling projects will help you add the most resale value to your home.

Sometimes, your home is one of the largest investments in your ‘portfolio’. Whether you are looking to stay in your home for a while or are considering selling soon, it’s important to pay attention to which remodeling projects will help you add the most resale value to your home.

According to the Remodeling 2016 Cost vs. Value Report as compiled by www.costvsvalue.com for the Denver area, these are the midrange projects shown to be the best bets when remodeling. Continue reading

Watch those Medicare Part B & Part D (Prescription Drug Coverage) Premiums: You May be Paying Higher Premiums than you Should!

For our seniors 65+ and those caring for seniors…

For our seniors 65+ and those caring for seniors…

Did you know that if your income has dropped significantly you may be eligible for a reduction of your Medicare Part B & and Part D (Prescription Drug Coverage) premiums?

If you’ve ever received a letter from Social Security telling you that your income level causes you to pay extra premiums on your Medicare Part B and Part D, then you should be aware of these rules.

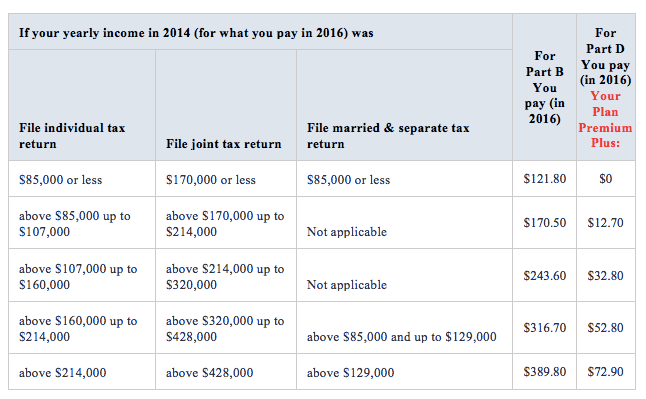

The Social Security Administration receives data that is two-years old, specifically your Modified Adjusted Gross Income (MAGI), each year from the Internal Revenue Service (IRS) and uses this information to determine the amount of your monthly premiums. If your income has dropped below specific thresholds, your premiums will decrease and vice versa. See the chart below for a breakdown of income levels and premiums required in 2016.

The important thing to note is that you don’t have to wait for two years for Social Security to get updated information from the IRS. Instead, if you know your MAGI has dropped below the income threshold on which your current premiums are based, then you can file an appeal along with some required documentation of your current MAGI and request a review.

Required documentation is:

- A copy of your filed tax return and an IRS transcript;

- A letter or statement from the IRS stating they have corrected your tax information and explaining the correction;

- Your amended tax return, along with a letter from the IRS accepting your amended return or an IRS transcript; Your copy of your tax return that shows an obvious IRS transcription error in tax-exempt interest income; or

- Your declaration under penalty of perjury that you lived apart from your spouse for the entire year when you filed your income tax return as “married Filing separately”. (source)

If the Social Security Administration finds that you’ve been paying a higher premium than you should have been, then they will refund the excess within 30 days of notifying you of their findings. So don’t wait, keep an eye on your income level and if you’re due a reduced premium, get filing!

For additional information read publications, Medicare Premiums: rules for Higher-Income Beneficiaries (SSA Publication No. 05-10536) and Medicare Premiums: What You Can Do If you Think Your Income-Related Premium Is Incorrect (SSA Publication No. 05-10125).

Inside the Economy with SH&J: May 23, 2016

As we transition into summertime, the news is slowing and the economic committee reviews macroeconomic trends including a look at the Federal debt level and increased subprime lending (mostly in auto loans) as well as China’s continued investment in U.S. real estate. Additionally, hear what information about Saudi Arabia has been kept a secret for more than four decades and how much of the focus around the world is on treasuries and confidence. Post your questions below and we will answer them during our next Inside the Economy with SH&J in two weeks!

Include your Digital Assets in your Estate Plan

Digital assets include electronic investment or bank accounts, emails, documents and photographs stored in the cloud, social media accounts, online medical records, and so on. It is illegal for anyone to access your accounts without your permission even if they have your password and are acting as your fiduciary. Upon death or incapacitation, these accounts may be closed and the information lost forever or the accounts may be left open and subject to identity thieves.

Behind the Scenes: What the SH&J Team Has Been Reading

Did you know many members of our team are avid readers? Whether it is a good story or a book to help us improve as planners, you will often find our noses in a book during our downtime. Today we thought we would share our latest book reviews with you. We’d love to hear what you’ve been reading as well in the comments below!

Inside the Economy with SH&J: May 9, 2016

While our last discussion highlighted segments of the U.S. economy, this week’s discussion highlights segments of China’s economy. Gain insight on China’s debt bubble and the potential effect (or lack thereof) on the U.S. consumer, as well as a comparison of Corporate China today to Corporate America in 2005. This discussion also addresses the latest on U.S. consumer debt, auto sales and the labor markets. Listen in to hear about these issues and more, including updates on the U.S. energy bankruptcies.