For our seniors 65+ and those caring for seniors…

For our seniors 65+ and those caring for seniors…

Did you know that if your income has dropped significantly you may be eligible for a reduction of your Medicare Part B & and Part D (Prescription Drug Coverage) premiums?

If you’ve ever received a letter from Social Security telling you that your income level causes you to pay extra premiums on your Medicare Part B and Part D, then you should be aware of these rules.

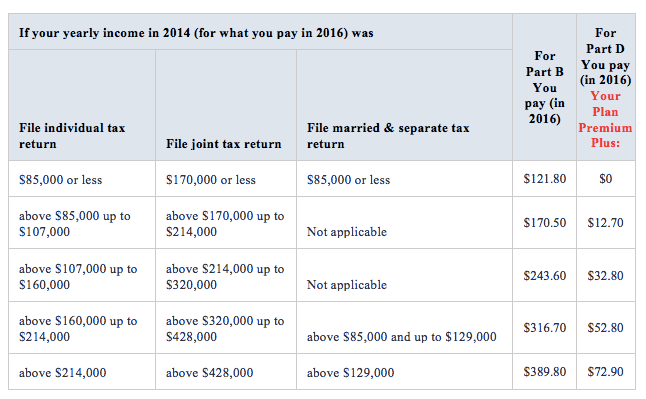

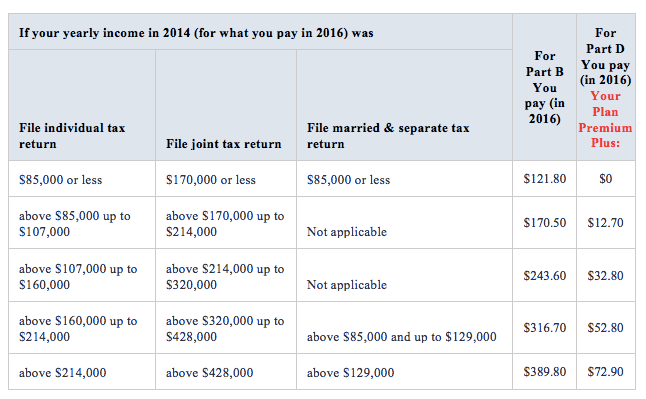

The Social Security Administration receives data that is two-years old, specifically your Modified Adjusted Gross Income (MAGI), each year from the Internal Revenue Service (IRS) and uses this information to determine the amount of your monthly premiums. If your income has dropped below specific thresholds, your premiums will decrease and vice versa. See the chart below for a breakdown of income levels and premiums required in 2016.

(source)

(source)

The important thing to note is that you don’t have to wait for two years for Social Security to get updated information from the IRS. Instead, if you know your MAGI has dropped below the income threshold on which your current premiums are based, then you can file an appeal along with some required documentation of your current MAGI and request a review.

Required documentation is:

- A copy of your filed tax return and an IRS transcript;

- A letter or statement from the IRS stating they have corrected your tax information and explaining the correction;

- Your amended tax return, along with a letter from the IRS accepting your amended return or an IRS transcript; Your copy of your tax return that shows an obvious IRS transcription error in tax-exempt interest income; or

- Your declaration under penalty of perjury that you lived apart from your spouse for the entire year when you filed your income tax return as “married Filing separately”. (source)

If the Social Security Administration finds that you’ve been paying a higher premium than you should have been, then they will refund the excess within 30 days of notifying you of their findings. So don’t wait, keep an eye on your income level and if you’re due a reduced premium, get filing!

For additional information read publications, Medicare Premiums: rules for Higher-Income Beneficiaries (SSA Publication No. 05-10536) and Medicare Premiums: What You Can Do If you Think Your Income-Related Premium Is Incorrect (SSA Publication No. 05-10125).

Sometimes, your home is one of the largest investments in your ‘portfolio’. Whether you are looking to stay in your home for a while or are considering selling soon, it’s important to pay attention to which remodeling projects will help you add the most resale value to your home.

Sometimes, your home is one of the largest investments in your ‘portfolio’. Whether you are looking to stay in your home for a while or are considering selling soon, it’s important to pay attention to which remodeling projects will help you add the most resale value to your home.